Best Stock Market Classes in Indore

Diploma in Stock Market

.png)

Course Introduction

Introduction

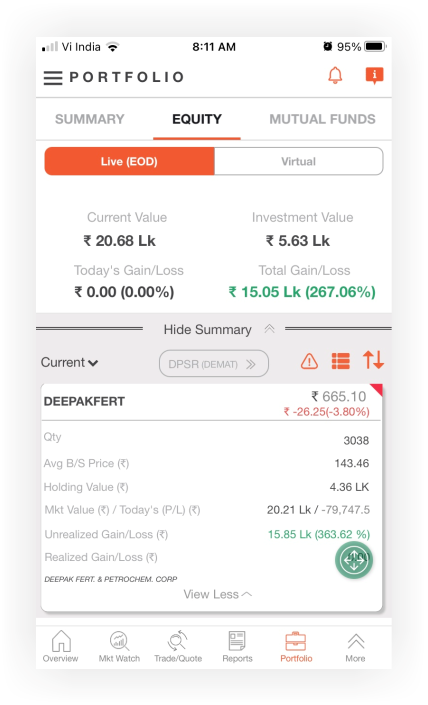

Embark on an exhilarating journey into trading with our Stock Market Trading Course. Learn everything you need to know, from market trends to practical trading skills. It is led by an experienced trainer with over 12+ years of trading experience and nine years of teaching.

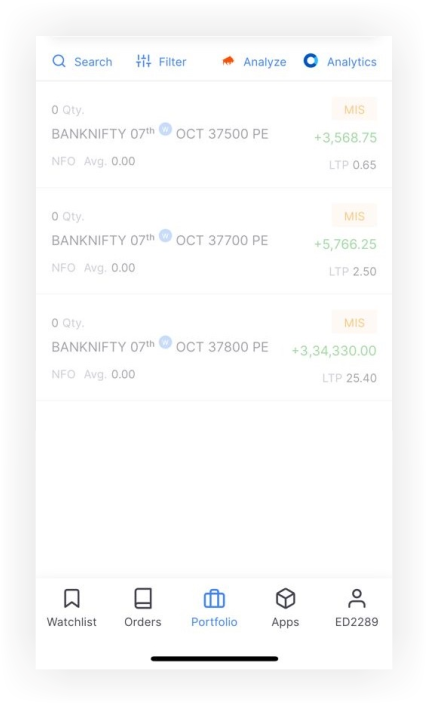

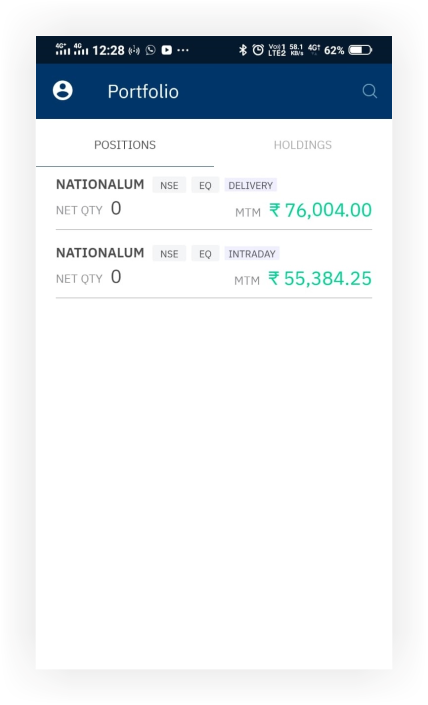

You'll explore technical analysis, cash segment trading, and futures & options trading in a way that's easy to understand. Discover how to manage risks, make wise investment decisions in IPOs, and analyze global markets. Our course is unique because it's not just theory – it's all about hands-on experience.

In our Live Trading Sessions, you can apply what you've learned in real time. We keep our class sizes small so you can get personalized attention and have a chance to ask questions. Plus, you'll receive study material to support your learning.

Whether you want to start a new career or enhance your trading skills, our Stock Market Trading Course is the perfect stepping stone.

So why wait? Enroll for the best stock market course in Indore and gain the confidence to navigate the stock market with ease!

Course Details

Details

Introduction: Market Participants, Financial Intermediaries, and Regulator

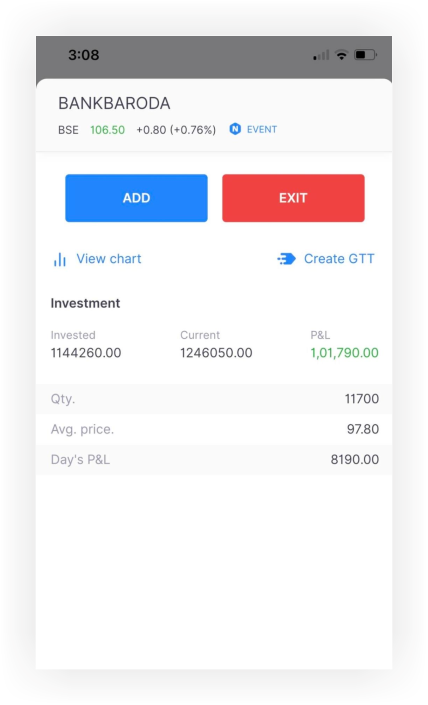

Primary Market: IPO Investing Strategy

Secondary Market: Global Markets Analysis, Corporate Actions, Live Online Trading, Analyzing Shareholding pattern and FII's & DII's Buying/Selling

Introduction to Technical Analysis: Price & Volume Analysis and Types of Charts

Chart & Trends: Timeframe, Support & Resistance, Trend Lines and Channels

Candle Stick Charts: Single and Double Candlestick

Major Indicators & Oscillators: EMA, VWAP, RSI, Supertrend and Pivot Points

Chart Patterns: Reversal and Continuation

Trading Strategies: Smart Money Concept, Price Action and Dow Theory

Target & Stop Loss Price: Using Heikin Ashi Strategy

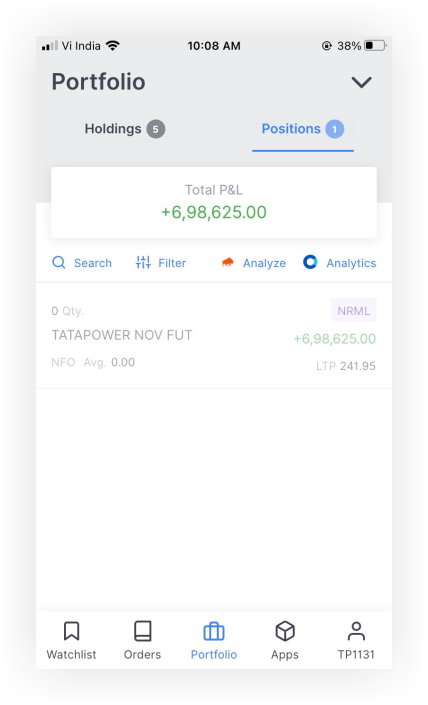

Trading Type: Intraday, Swing and Positional Trading

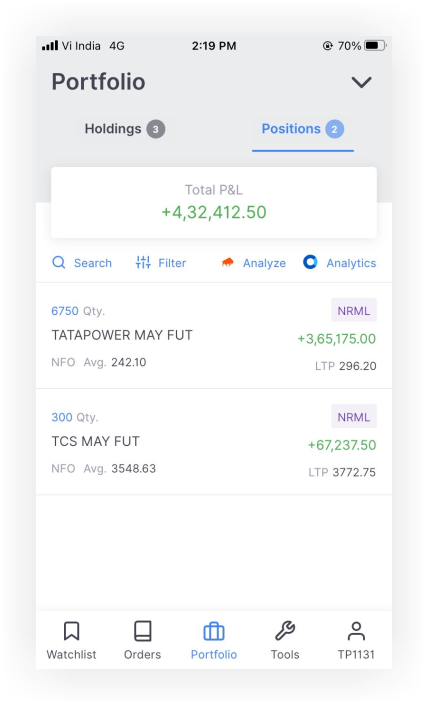

Futures: Introduction, Pricing, Trading, Margin and Cost-of-Carry

Options: Introduction, Option Pricing, Factors Affecting Option Price and Trading

Option Strategies: Protective Put, Covered Call, Bull & Bear Spread, Straddle, Strangle and Iron Condor

Option Greeks: Delta, Gamma, Theta, Rho and Vega

Option Chain Analysis

Corporate Actions: Impact of Dividend on F&O price

Trading Strategies: Smart Money Concept, Dow Theory and Zero Hero Index Trading

Professional Trading Setup

Option Writing

Target & Stop-Loss Price

Trading Type: Intraday, Swing and Positional Trading

Risk-Reward Ratio: Evaluating The Ratio Based On Accuracy Levels

Position Sizing: Calculating The Appropriate Quantity to Trade

Stop-Loss Orders: Trading With Strict Stop Loss

Behavioral Biases: Loss Aversion Bias, Disposition Effect, Overconfidence Bias, Confirmation Bias, Herd Mentality, Recency Bias, Gambler's Fallacy and Self-attribution Bias

Risk Tolerance: Understanding Individual Risk Tolerance

Career Opportunities

Opportunities

Trader

Investor

Broking

Entrepreneur

Research

2 Months Duration

2 Months Duration  100% Practical Training

100% Practical Training  Study Material

Study Material  Faculty

Faculty  Certificate

Certificate  Faculty Experience

Faculty Experience  Training Day's

Training Day's  2 Months Duration

2 Months Duration  100% Practical Training

100% Practical Training  Study Material

Study Material  Faculty

Faculty  Certificate

Certificate  Training Day's

Training Day's