Best Future and Option Trading Course

Advance Trading Strategies

.png)

Course Introduction

Introduction

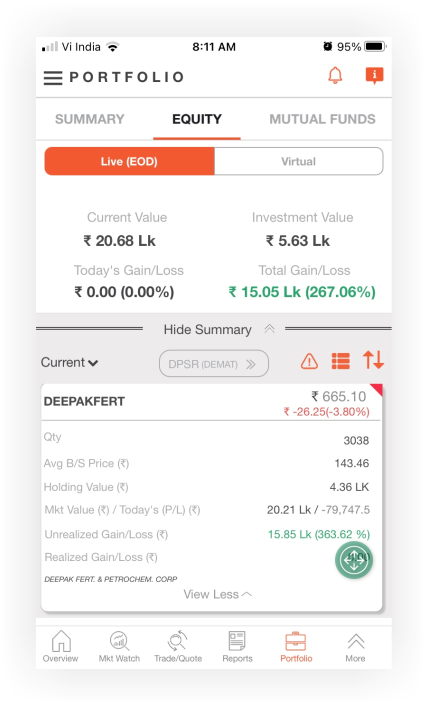

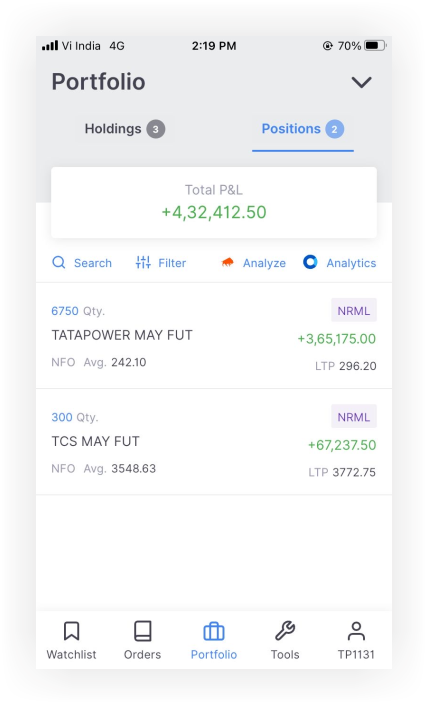

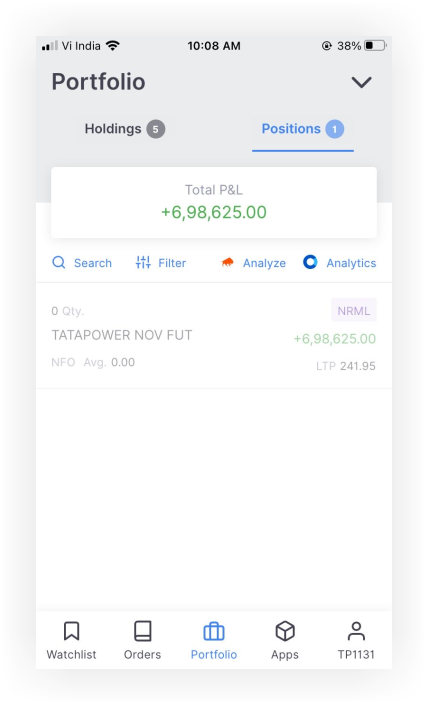

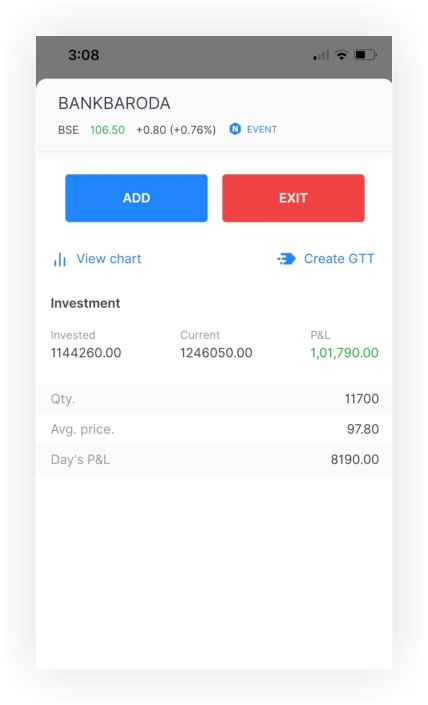

Welcome to the Future and Option Trading course! This course will teach you about the exciting world of future & option trading. Future and option are financial tools that enable traders to take informed decision on the prices of stocks, commodities, and currencies

Throughout this course, you will thoroughly understand the fundamentals of future and option trading, including option chain analysis, option Greeks, options strategies, and professional trading setup. You will also have the opportunity to learn future and option trading, which is a crucial aspect of this course. Additionally, you will learn how to analyze markets and create trading plans using future and option, along with exclusive trading strategies for a bank nifty, nifty 50, and nifty financial services.

The course will provide experienced traders with the skills and knowledge needed to succeed in the dynamic world of future and option trading. So, let us get started and learn future and option trading in this comprehensive course on future and option trading.

Course Details

Details

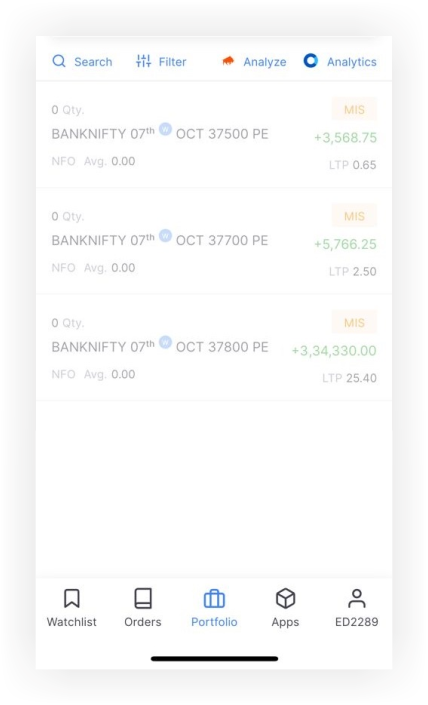

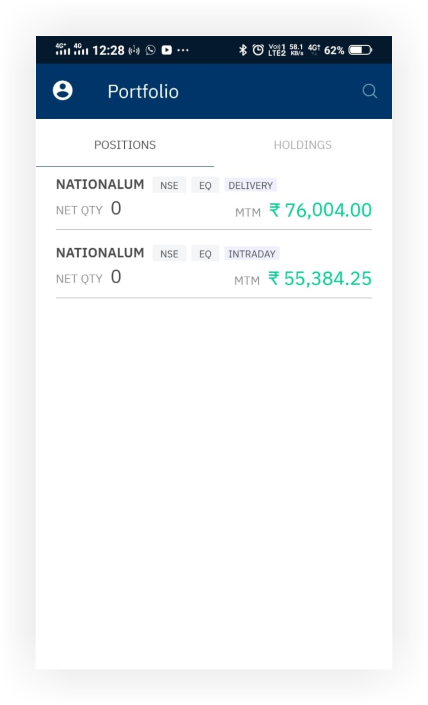

Option Chain Analysis: Put Call Ratio, Put Call Volume, Long & Short Build Up, Long & Short Unwinding, Open Interest Analysis, and etc

Option Strategies: Bull Spread, Bear Spread, Straddle, Strangle and Zero Cost Collar

Option Greeks: Delta, Gamma, Theta, Vega and Rho

Exclusive Index Trading Strategy: Nifty Bank, Nifty 50 and Nifty Financial Services

Price Action Trading Using Heikin Ashi Candles

Scalping

Reversal Trading Strategy Using Bollinger Bands

Live Market Application

Price Action Trading Using Elliott Wave

Career Opportunities

Opportunities

Trader

Advisory

Broking

Entrepreneur

Research

1.5 Months Duration

1.5 Months Duration  100% Practical Training

100% Practical Training  Faculty

Faculty  Practise Session

Practise Session  Certificate

Certificate  Training Day's

Training Day's  1.5 Months Duration

1.5 Months Duration  100% Practical Training

100% Practical Training  Faculty

Faculty  Practise Session

Practise Session  Certificate

Certificate