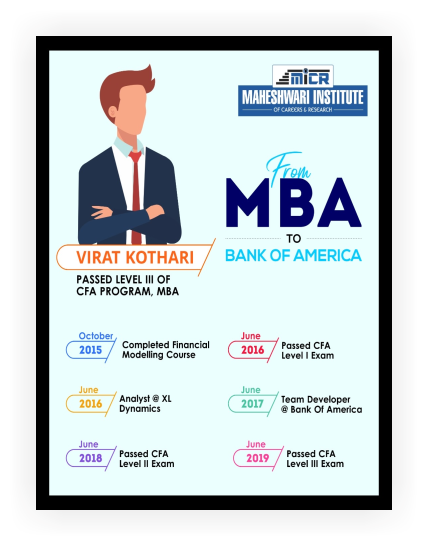

Best CFA Level 1, 2 & 3 Coaching in India

CFA速

Course Introduction

Introduction

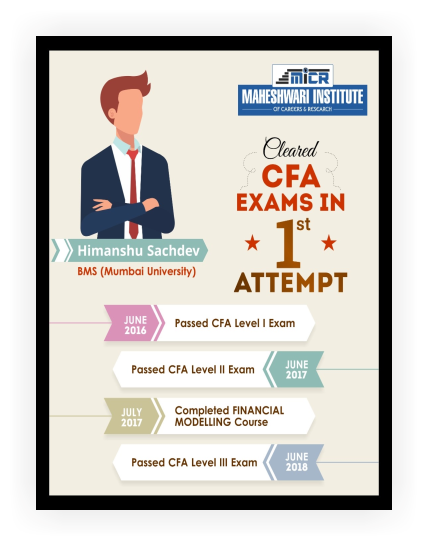

Started in 1963 by CFA® Institute in the USA, Chartered Financial Analyst (CFA®) is now one of the most recognized finance qualifications in finance & investments. The CFA® exam comprises Level I, Level II, and Level III. Candidates can complete all three levels of the CFA® exam in 1.5 – 2Yrs. Even though clearing CFA® Level 1 exam creates opportunities for candidates to start their careers in top-notch investments and finance companies. Completing the CFA® exam helps candidates fetch enriching job profiles and pay packages.

Course Details

Details

More than 2, 00,000+ candidates have cleared level III of the CFA Program and work in 135+ countries worldwide.

19 Regulatory bodies worldwide recognize the CFA charter as a proxy for meeting specific licensing requirements.

More than 125 distinguished colleges and universities worldwide have incorporated most of the CFA Program curriculum into their courses.

| CFA Exam Details | Level I | Level II | Level III |

|---|---|---|---|

| Exam Mode | ONLINE | ONLINE | ONLINE |

| Month | Feb, May, Aug & Nov | Feb & Aug | May & Nov |

| Type | Objective | Objective | Objective & Subjective |

| Duration | 4.5 hrs | 4.5 hrs | 4.5 hrs |

| No. Of Questions | 180 | 180 | Item Sets & 90 |

| Historical Pass % (2013’- 2022’) | 41% | 45% | 52% |

| Topic Area | Level 1 | Level 2 | Level 3 |

|---|---|---|---|

| Ethical and Professional Standards | 15-20 | 10-15 | 10-15 |

| Quantitative Methods | 8-12 | 5-10 | - |

| Economics | 8-12 | 5-10 | 5-10 |

| Financial Reporting and Analysis | 13-17 | 10-15 | - |

| Corporate Finance | 8-12 | 10 | - |

| Equity Investments | 10-12 | 10-15 | 10-15 |

| Fixed Income Investments | 10-12 | 10-15 | 15-20 |

| Derivatives | 5-8 | 5-10 | 5-10 |

| Alternative Investments | 5-8 | 5-10 | 5-15 |

| Portfolio Management and Wealth Planning | 5-8 | 5-15 | 40-55 |

| Total | 100 | 100 | 100 |

The selected exam month has to be 11 months or lesser before your graduation month for your bachelor's degree, OR

Complete a bachelor's or equivalent program and have received a degree from the college/university, OR

Have a combination of 4,000 hours of work experience or higher education that was acquired over a minimum of three sequential years and achieved by the date of registering for the Level I exam, AND

Valid international passport.

| CFA Exam Fees in USD | Early Registration | Standard Registration |

|---|---|---|

| Level I | 900+GST | 1200+GST |

| Level II | 900+GST | 1200+GST |

| Level III | 900+GST | 1200+GST |

| One time enrolment fee USD 350$ + GST |

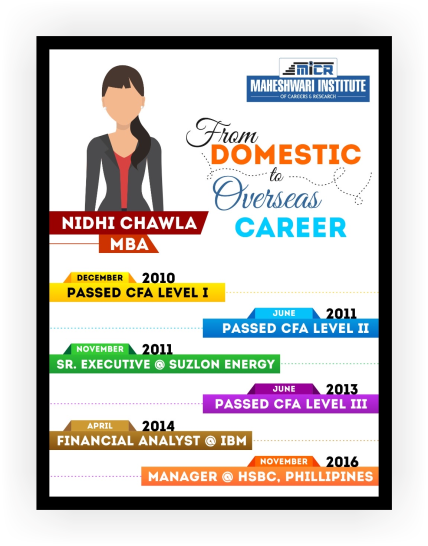

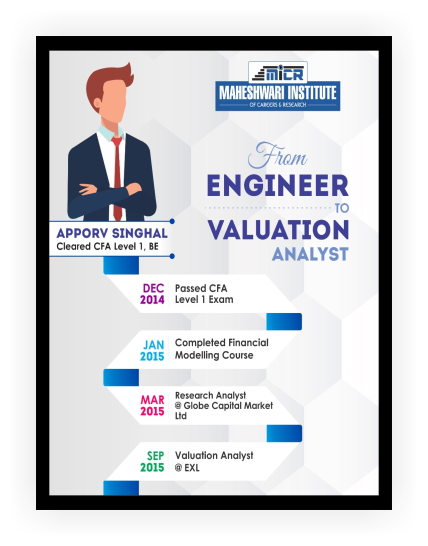

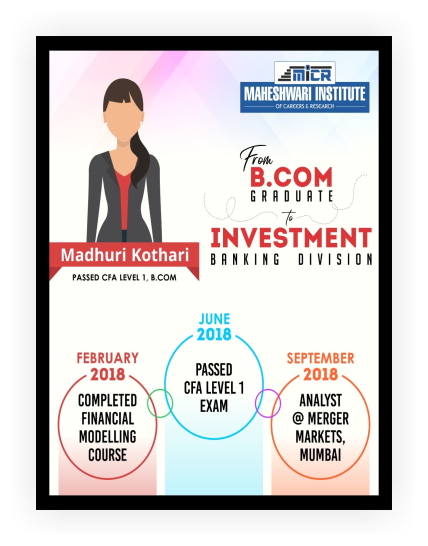

Career Opportunities

Opportunities

Portfolio Manager

Buy Side Analyst

Sell Side Analyst

Research Analyst

Risk Management

Credit Analyst

Consultants

Economist

Chief Level Executive

Investment Banker

Hedge Fund Manager

Financial Advisor

Financial Analyst

Derivative Analyst

Private Equity Analyst

And many more …..

6 Months Duration

6 Months Duration  Study Material

Study Material  Questions Practice

Questions Practice  Classroom Test

Classroom Test  Mock Test

Mock Test  Faculty

Faculty  Placement Assistance

Placement Assistance  Placement Assistance

Placement Assistance  Training Day's

Training Day's  6 Months Duration

6 Months Duration  Study Material

Study Material  Questions Practice

Questions Practice  Classroom Test

Classroom Test  Mock Test

Mock Test  Faculty

Faculty  Placement Assistance

Placement Assistance  Training Day's

Training Day's