Best Technical Analysis Course

Technical Analysis

.png)

Course Introduction

Introduction

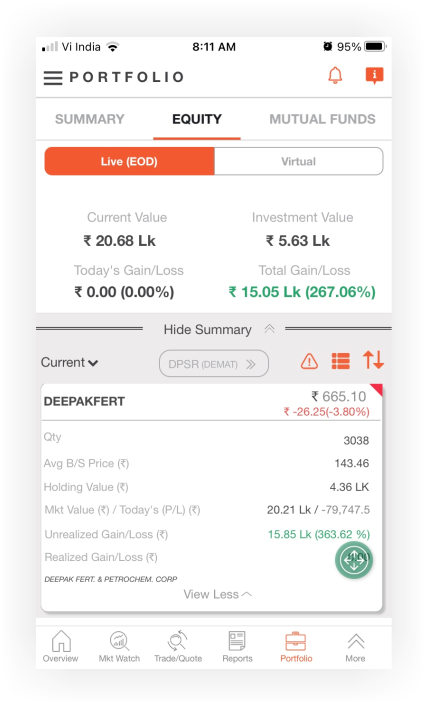

The technical analysis course is designed to give comprehensive understanding of technical analysis and its practical implication in trading

In this stock market technical analysis course candidates will learn to apply technical analysis to financial markets, including stocks, commodities, and foreign exchange. The course will cover the trading strategies for different trading segments, including futures & options (F&O) and cash

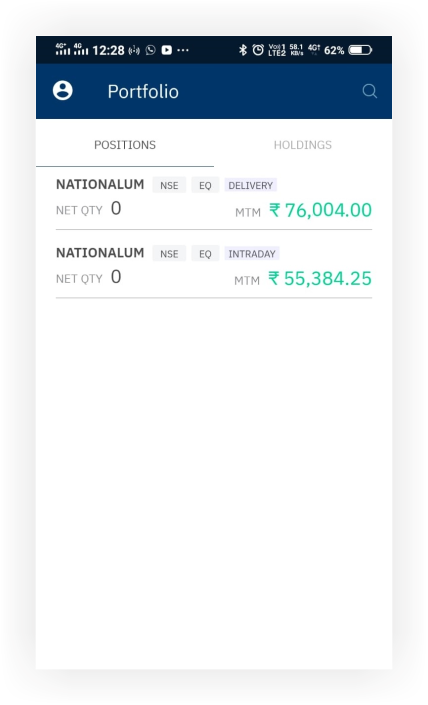

In addition to technical analysis techniques and trading strategies, students will learn how to manage risk and optimize returns by setting stop-loss orders, managing position sizes, and using other risk management tools

Students can apply the techniques and strategies learned in class throughout the course to live market trading. By the end of this stock market technical analysis course, candidates will thoroughly understand technical analysis and its applications in financial markets. They will master the skills to make informed trading decisions using specialized analysis techniques

So why wait? Enroll for the best technical analysis course in India and take the first step toward achieving your trading goals!

Course Details

Details

Technical Analysis: Introduction, Tools, and Assumptions

Price: Line Chart, Bar Chart, and Candlestick Chart

Volume: Interpretation & Analysis

Timeframe: Interpretation and Application

Support and Resistance: Meaning and Identification

Trend Lines: Implication, Reliability, and Uses

Trends: Uptrend, Downtrend and Sideway/Horizontal trend

Channels: Upward, Downtrend and Sideways Price Channel

Single Candlestick: Marubozu, Doji, Spinning Tops, Hammer, Hanging Man, and Shooting Star

Multiple Candlestick: Bullish & Bearish Engulfing Pattern, Piercing Pattern, Bearish & Bullish Harami, Dark Cloud Cover and Morning & Evening Star

EMA Crossover, RSI, MACD, Supertrend, and Pivot Points

Reversal: Head and Shoulders, Double Tops and Bottoms, Triple Tops and Bottoms, Inverse Head and Shoulders

Continuation: Cup and Handle, Triangles, Flag and Pennant Wedge

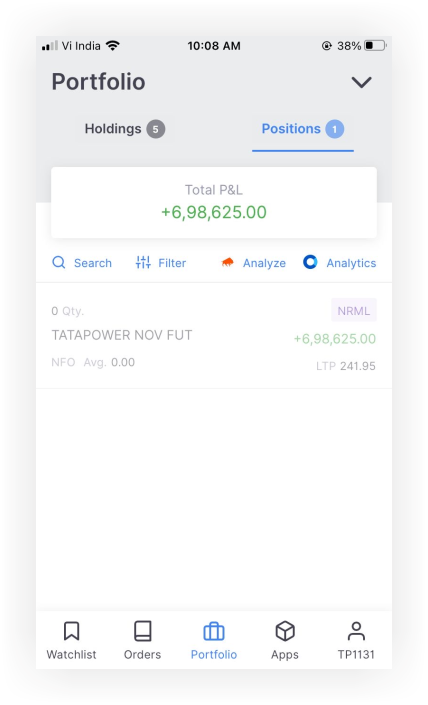

Stop Loss & Target Price: Calculation Using Advance Gann Theory

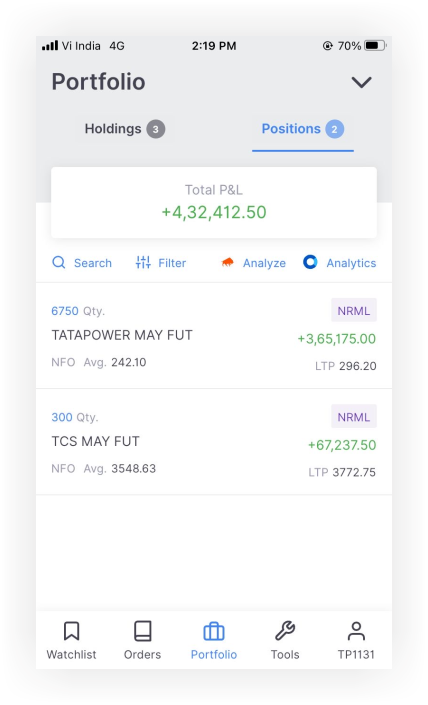

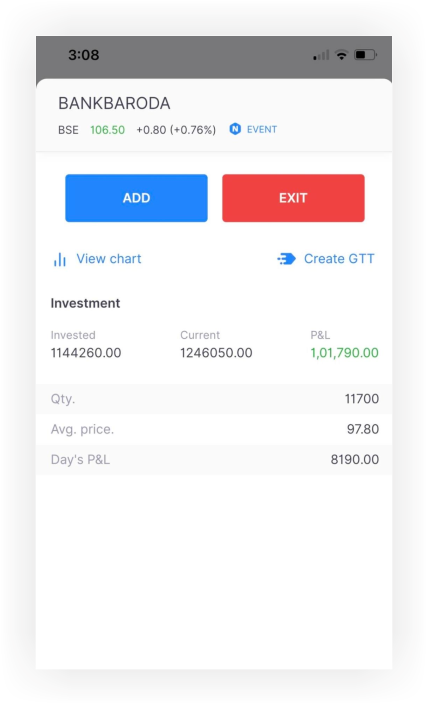

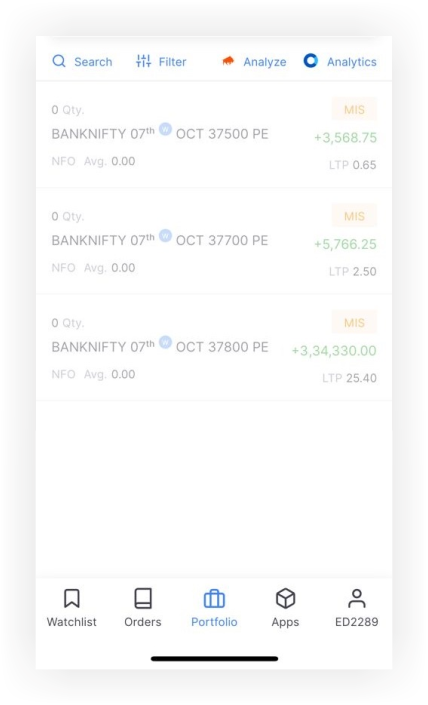

Trading Strategies For Cash Segment & Futures: Open Low / Open High, Cross Over and Price Action

Exclusive Option Trading Strategy

Risk Management: Risk-to-Reward Ratio and Risk Managed Trading Qty

Others: Trading Checklist, and Live Screeners & Scanners

Career Opportunities

Opportunities

Trader

Advisory

Broking

Entrepreneur

Research

1.5 Months Duration

1.5 Months Duration  100% Practical Training

100% Practical Training  Study Material

Study Material  Faculty

Faculty  Practise Session

Practise Session  Certificate

Certificate  Training Day's

Training Day's  1.5 Months Duration

1.5 Months Duration  100% Practical Training

100% Practical Training  Study Material

Study Material  Faculty

Faculty  Practise Session

Practise Session  Certificate

Certificate  Training Day's

Training Day's