10000+

10000+

CANDIDATES TRAINED

1000+

1000+

PLACEMENTS

40+

40+

CORPORATE TRAINING

100+

100+

SEMINARS

500+

500+

Internship

50+

50+

Workshops

Sumit is one of the few CFA charterholders around. He has diversified experience from corporate banking to portfolio management. He started working with Standard Chartered Bank managing FX derivatives, structured products, and banking solutions for corporate clients. Later he shifted his focus into commodities research and started working at Pee Aar Securities Ltd where he was responsible for managing commodity fund with an AUM of INR1bn+.

By tapping into his professional work combined with his zeal to impart knowledge in the financial domain, he ventured into training. He has conducted interactive and experiential seminars/workshops in top B schools on various finance topics. At MICR; Sumit takes care of training young minds in complex subjects like Fixed Income, Alternate Investment, Economics, Currency, and Derivatives with a practical approach. He also takes care of the placement assistance program leveraging his strong network with Corporates and Financial institutes.

Aditya Bahety has a rich experience of 6+ years working in investment banking wing with top-notch globally recognized firms like Motilal Oswal and PhilipCapital. He was working as an Equity Research Analyst in their institutional research, thereby communicating with FII's, DII's and recommending them about the stock based on fundamental analysis. His work area also included communication with the corporate (CEO, CFO's) to understand their view about the performance of their respective companies. He covered stocks for the Indian markets and built detailed financial models and to publish periodic theme-based company/industry reports. He has a thorough understanding of all financial nuances like bringing out an IPO to M&A and has an in-depth knowledge of the financial sector, its drivers, valuation methodology/parameters and macroeconomic inter-relationship with the industry.

At MICR; Aditya focuses on career counseling for students helping them to achieve their career objectives. He is also an active speaker at various forums and publishes his articles focused on equity markets in India. Along with this, he imparts training in Fundamental Research, Equities, Portfolio Management, Financial Modelling, Financial statement analysis, and Corporate Finance.

Abhishek started his career with Reliance Capital AMC, wherein he used to cater to the investment needs of UHNI and HNI clients. Primarily focused on Liquid, Gilt, and Debt oriented funds, he helped large corporate clients as well to fulfill their portfolio needs/requirements. He has also worked with manufacturing firm Partap Wires Pvt Ltd heading the corporate finance department.

He has strong academics and was a BE (honors) additionally he was awarded the scholarship based on his excellent performance during MBA. He is a stock market enthusiast and has excellent command of technical analysis and manages his fund of INR10mn+. At MICR, He takes care of training in the stock market & Technical analysis course making the candidate's employment ready. He also helps candidates preparing for various NISM exams.

Shailendra has excellent quantitative skills helping candidates preparing for various NISM certifications. The rigorous training provided to candidates along with practice questions has helped most of the candidates in clearing the NISM exam in 1st attempt.

.png)

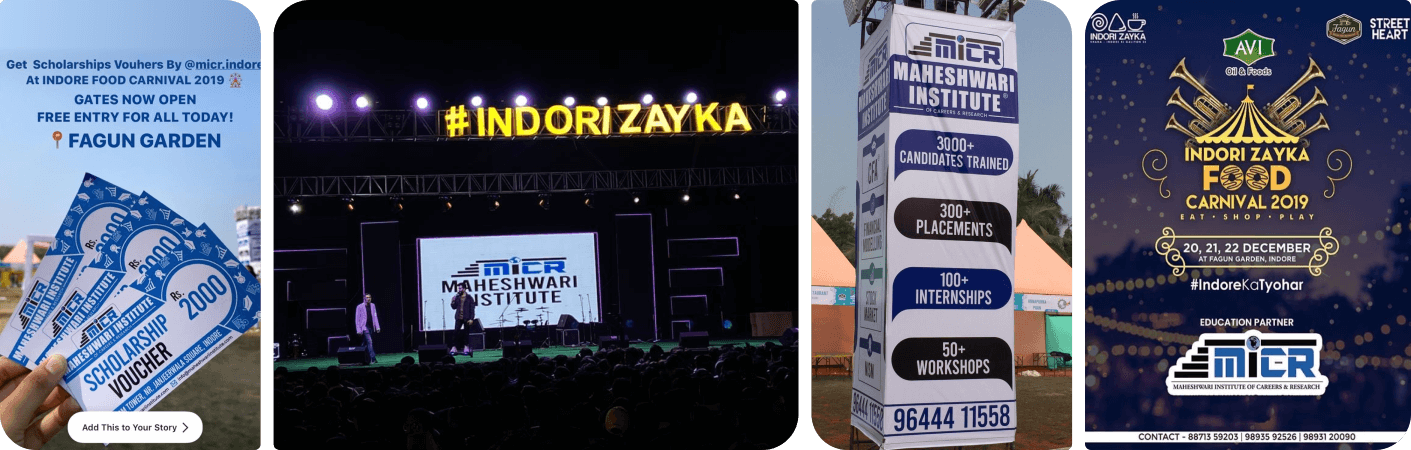

We are proud to have been the education partner of Indorizayka Food Carnival 2019 which had a gathering of 50K+ visitors

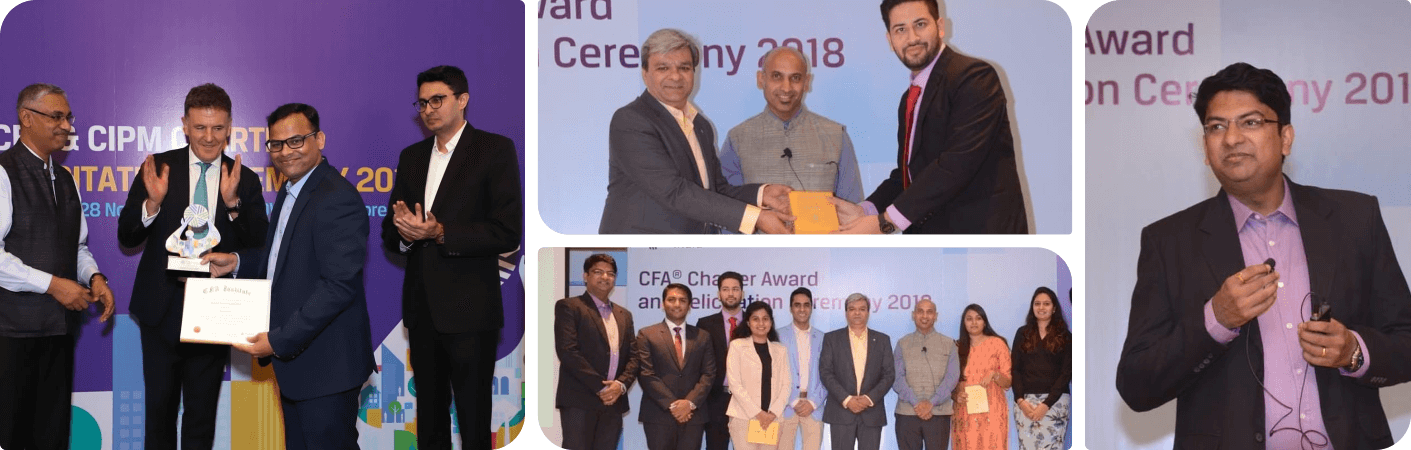

Our students and training partner awarded with the most prestigious finance designation in the world

Our Institute Director & Co-founder Mr. Sumit Maheshwari, CFA速 has been invited as a judge in Stock Market Trading competition organized by the top B-School of Indore

Various sports activities are organized every week with an objective to remain fit and develop friendly relationship between students and faculties

Our institute students have won the financial modeling competition organized at Finclave 2019 by Prestige College (PIMR)

5/5

5/5

A really very good class to learn Financial Modelling. It covers all the practical aspects and not just focus on bookish knowledge only. Highly recommended for those who want to make future in Finance.

5/5

5/5

Maheshwari institute is the best coaching for financial modelling course. Teachers are very supportive and the education that they are providing will really help me in exploring my career in finance field.

5/5

5/5

I'm recently certified from maheswari institute (financial modeling) and also planning for further training . And I can say that it's one of the best institute for financial education specially in Indore with a very friendly environment and high quality practical training And learning. I warmly suggest you to visit once ..& thanks respecting my thoughts.

5/5

5/5

I have done financial modelling course in which they provided very appropriate and useful study material along with that class session were so nicely conducted. Faculties are well qualified and helping. Joining this course is really worth it !! Thanks MICR

5/5

5/5

I have done the course of financial modelling and personally I gained a lot of practical knowledge from the faculties. The faculties at MICR are very supportive and coperative. Apart from the course syllabus they gave you extra task to get familiar with the real world and how one should apply the learnings and knowledge in the real corporate world.

5/5

5/5

MICR is the best place for CFA preparations and for other courses. The study material is 100% aligned with the CFA curriculum.

5/5

5/5

I had an amazing learning experience at MICR. All the teachers (Sumit Sir, Aditya Sir, Abhishek Sir) are very experienced and supportive. All my doubts during the CFA Level 1 course, be it during or after the class, were cleared by them. Highly recommended.

4/5

4/5

Best institute in central India for CFA. There are doubt clearing sessions along with regular test series. Teachers here have a through knowledge that helps in enhancing one's capabilities

5/5

5/5

The experience of learning from the tutors was incredible. They are really good at teaching and explaining through examples and helping me to understand everything. Had there been any other professional institutes they would not have done so much as MICR has done for me. I’m very sure about it. And I cleared Level 1 without any stress and confusion.:)

5/5

5/5

Great institute. Great faculties. Best place in Indore for all finance related courses. I did my CFA level 1 coaching and financial modelling course from here and am very satisfied with the results. All the faculties provide personal attention and guide very properly. They also provide placement assistance. All in all a great place for finance related courses.

5/5

5/5

its one of the best institute i have studied with excellent teachers who provide all the help and doubt clearing during the course .Recommended for sure.I completed Financial Markets & Financial Modelling Course

5/5

5/5

Best institute in central india for financial training.I have taken classes for financial modelling, financial markets and CFA level 1 from this institute. Excellent faculty and amazing support from then.

5/5

5/5

Financial markets and financial modeling course.. Faculty is well enough with good experience and this course was fruitful for me. Thankyou

5/5

5/5

I have done financial markets and financial modeling from MICR. The best part of the Institute is the faculty. They teach in a very much practical way rather than other institutions who teaches in theoretical terms. We were also given practical assignments in financial modeling which was way too helpful. Rather than doing financial modeling from an online course which just speak and go.

5/5

5/5

I have done Financial Market and Financial Modelling course from MICR and it was an wonderful experience learning in Live Market. Faculties were awesome and very helpful always ready to solve our doubts with full patience. Class infrastructure was also good and decent. Module content was also to the point. Overall great learning and strongly recommended!

5/5

5/5

One of the best institutes to learn Stock Market Trading.

5/5

5/5

An absolutely amazing place to learn about the share market and different trading Strategies. I have completed 3 of the courses from this institute diploma in stock market, technical analysis and advance technical and currently preparing for CFA Level 1 from the same. It has been an fantastic experience to learn. The teaching facilities are very knowledgeable and provide knowledge about it from the zero level to the higher end and gives enough practice to make their students learn about it.

5/5

5/5

One of the best Institute for Stock Market in Central India. Must join to Learn Trading.

5/5

5/5

I have joined this ccg for stock market and technical analysis course. The facilities are very experienced and supportive. It was a great experience overall.

5/5

5/5

I have done Basic stock market course and Advance Technical course from the institute it was a wonderful experience learning in love market. Faculties are awesome and very helpful

5/5

5/5

Faculties are so great here and hand on in live trading sessions were very helpful. And for CFA programme coaching it is really central India's best institute.

5/5

5/5

I recently have completed Advance Trading. I learnt so many strategies of trading which are actually applicable and from those strategy I have earned good profit and now also earning it. Totally worth doing it. great experience.....

5/5

5/5

Did "Advanced Trading strategy" course from here and whether you're a rookie or a veteran trader, you'll learn a lot and it will change the way you trade. The strategies taught are well backtested and taught on live market. You'll get ample time to practice them as well. Knowledge learned from here will reflect in your trading account.

5/5

5/5

Maheshwari Institute is a go to place for learning about the stock market. I started my journey of stock trading and investments here. Completed Financial Markets & Modeling and Advance Technical and trading strategies course. Techniques and trading strategies taught by Abhishek Sir enhanced my game and enabled me to take better risk to reward trades. Sumeet Sir taught financial markets and macro economic analysis in a very practical manner with interesting case studies and examples which aided in better understanding of the same and helped me clear CFA Investment Foundations program.

4/5

4/5

Maheshwari institute is a great institute for learning technical and fundamental analysis. Most importantly,the techniques taught here are completely relevant and actually works while doing trading.

5/5

5/5

Done technical analysis course, It was a nice experience got to learn lot about trading and its strategies

5/5

5/5

Had the amazing time here. Done my technical analysis course from here. The teacher is great always have your back. You'll get all the knowledge you need for trading. It's all the worth

5/5

5/5

Best trading strategies I have learned yet. Super qualified faculty(CFA holders). Awesome classroom with Air-conditioning. Live market analysis. Strongly recommend for learning technical Analysis and CFA preparation.

4/5

4/5

I have done Technical Analysis course. It was wonderful experience to learn in live market. Atmosphere is very inspiring. Got to know various trading and investment strategies

5/5

5/5

i have an amazing experience studying technical analysis . the faculty their was too good and also enjoyed studying their.

5/5

5/5

Maheshwari institute is a great institute for learning technical and fundamental analysis. Most importantly,the techniques taught here are completely relevant and actually works while doing trading.

5/5

5/5

Had the amazing time here. Done my technical analysis course from here. The teacher is great always have your back. You'll get all the knowledge you need for trading. It's all the worth

5/5

5/5

I have an amazing experience for technical analysis in maheshwari institute....the faculty was too good....I seriously enjoyed studying technical analysis their.